In a competitive market like Singapore, standing out is no easy feat. An impressive educational background can give you an edge in today’s fast-paced and diverse environment. It’s no secret that a good education can propel your career forward.

With a plethora of quality tertiary education options available both locally and abroad, pursuing overseas education has become increasingly popular among Singaporean students. The diverse range of courses and the immersive experience of studying abroad are highly appealing to students today.

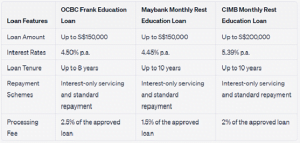

In this article, we will explore education loans and compare them to help you decide which study loan in Singapore for overseas education is best suited for you. We will provide information on loan amounts, interest rates, loan tenures, and repayment schemes.

Study Loan Singapore for Overseas Education

OCBC Frank Education Loan**

– Loan amount: Minimum: S$1,000; Maximum: Up to 10 times the borrower’s monthly income, up to S$150,000

– Interest rate: 4.50%

– Processing fee: 2.5% of the approved loan

– Repayment period: Flexible repayment options with a loan tenure of up to 8 years

– Eligibility: Available to Singapore citizens or permanent residents aged 21 and above with a minimum annual income of S$24,000. A guarantor or collateral may be required if the borrower’s income is insufficient to support the loan amount.

– Repayment options: OCBC offers three repayment options: standard, graduated, and graduated plus. These schemes cater to different needs and resources.

Maybank

Monthly Rest Education Loan**

– Loan amount: Minimum: S$15,000; Maximum: Up to 8 times the borrower’s monthly income, up to S$150,000

– Interest rate: 4.45%

– Processing fee: 1.5% of the approved loan

– Repayment period: Flexible repayment options with a maximum loan tenure of 10 years

– Eligibility: Open to Singapore citizens or permanent residents aged 21 to 65. Guarantors are required for full-time studies, with specific criteria for guarantor eligibility.

– Repayment options: Maybank offers three payment schemes: interest servicing scheme, partial repayment scheme, and standard repayment scheme. These schemes accommodate various student situations.

CIMB Monthly Rest Education Loan**

– Loan amount: Minimum: S$1,000; Maximum: Up to 8 times the borrower’s monthly income, up to S$200,000

– Interest rate: 5.39%

– Processing fee: 2% of the approved loan

– Repayment period: Flexible repayment options with a loan tenure of up to 10 years

– Eligibility: Available to Singapore citizens or permanent residents aged 16 to 50 with a minimum annual income of S$24,000. A guarantor or collateral is required, and the guarantor must be an immediate family member.

– Repayment options: CIMB provides two payment schemes: interest servicing repayment and standard repayment scheme. These options align with the repayment schemes offered by other education loans.

Comparing the Study Loans

Here is a summary of the key features of the education loans:

Data as of January 2021

Other Option: Personal Loan**

If none of the top bank education loans meet your requirements, there is another option to consider. Bugis Credit offers the best personal loans that can support your further studies. As a reputable moneylender in Singapore, Bugis Credit provides reliable financial assistance.

It’s important to note that personal loans from Bugis Credit differ from the student loans discussed above. The flexibility of repayment schemes offered by student loans may not be available with personal loans. However, if you don’t meet the requirements for student loans or have a different preference, obtaining a personal loan from Bugis Credit can still help further your studies.

Closing

Pursuing further studies opens up opportunities for students to reach their full potential. As resources may be limited, education loans become a practical step to support your educational journey. The education loans discussed in this article can be helpful in your pursuit of a successful career.

We advise students to carefully consider their resources and the program they wish to pursue before deciding on an education loan. Factors such as interest rates, loan amounts, and tenures should be taken into account when choosing a study loan. Remember, a student loan is a tool that can help advance your career, provided you make the right choice.

For personalized guidance and competitive loan options in Singapore, you can contact SGP Credit:

Contact SGP Credit:

Website: www.sgpcredit.com.sg

Phone: +65 6466 1157

Email: info@sgpcredit.com.sg