How Credit Scores Affect you and How to Improve Them

You may have come across the term credit scores and wondered what it is all about. You also wonder why financial organizations look at them when applying for a personal loan. The banks and other financial institutions need to know how disciplined you are in terms of finances and to know what kind of a person they are dealing with. A credit score will act as an indicator to prove if you are a serial defaulter or whether you pay your debts in good time.

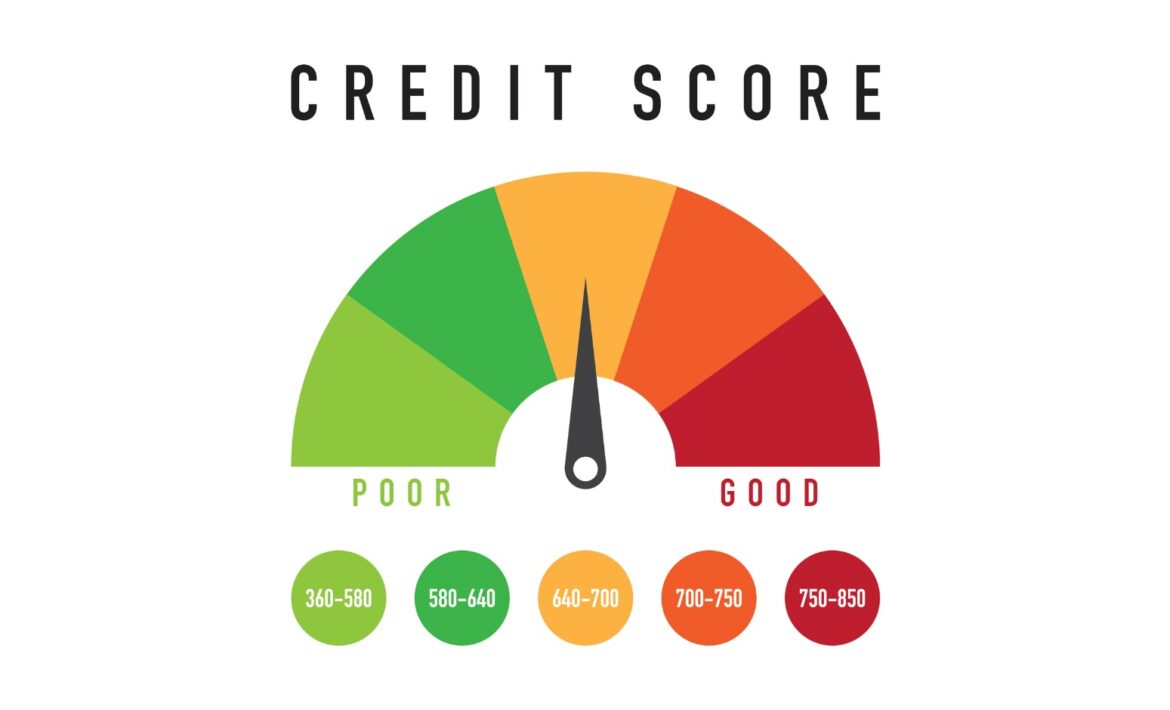

People who pay their debts on time havehigh credit scores, and financial organizations would like to deal with them more. Credit scores range from 300-850. When determining the interest rate, people with high credit scores get a more friendly rate than those with a lower score. Therefore, it is important to maintain a good credit score because it will translate to better terms of credit.

How to Improve Good Credit Scores

As much as it calls for sacrifice and financial discipline, borrowers must maintain a good score to meet their short- and long-term obligations through borrowing Some of these obligations include buying a house, starting a business or making a major purchase that you can’t use with your monthly salary.

- Analyze Your Credit Report

Reviewing your credit report allows you to know where you are going wrong and put up measures immediately to curb any negative effects. Three credit bureaus in Singapore carry the credit information, namely, Equifax, TransUnion and Experian. This free report can be generated at least once a year from the official website.

It also helps one to see if there are any errors in the report and file a dispute before it’s late. Some of these mistakes arise from misspelled names, wrong addresses orwrong reporting of dates.

All these can lead to delinquentdebts or open accounts that that are honestly false arrears.

You stand a chance to improve your credit scores by notifying the authorities about this misinformation. This has been evident, and close to 20% of people who reported such issues were able to improve their scores.

- Limit new Credit Requests and Hard Inquiries

The two main types of inquiries are Hard and Soft inquiries. While soft inquiries are about checking your credit scores or allowing a lender to check them, hard inquiries refer to taking new credit such as a mortgage, long-term loans and the like.

Hard inquiries will adversely affect your credit scores negatively. In most cases, banks often think that taking loans now and then is a show that one of facing financial difficulties and the reason to keep off from taking new loans often.

- Pay your Bills on Time

Even if you apply the many strategies around to improve your credit scores, they will never improve if you do not pay your debts in good time. The worst part is that you can remain with a negative credit report for more than seven years due to late payment.

If you face unexpected challenges that have led to delayed payments, always contact your creditors and negotiate on an agreeable figure which can work better for you.

Banks and licensed money lenders usually support the same. If you look at one of the reputable moneylenders in Singapore, the SGP credit, you will find many favourable terms for loan repayment. All that is needed is to ensure that there is formal communication and you will be sorted in good time to avoid messing with your scores.

Remember that any time you miss the repayment, the account will be marked as delinquent and continue hurting you.

- Set Up reminders on the Repayment Dates.

Sometimes, it is not about lacking funds, but people tend to forget their repayment dates. To avoid this, set upa reminder to show time and commitment. You can also set up an automatic payment to ensure that by the time a loan account demands money, it will automatically receive the instalment and maintain your scores well.

- Maintain Old and Cleared Accounts Open.

Even when you have cleared your loans, leaving your accounts open is recommended to have an extended credit history. It proves to the money lenders that you can maintain good credit history for a long duration. Otherwise, closing will lower the available credit and increase the credit utilization ratio.

On the same note, ensure you take action on any delinquent accounts. As much as the late repayments will still show in your credit accounts, taking action and repaying the loans will ensure that the paymenthistory is raised and the credit scores improve.

- Purpose of having a rating of 30% Credit Utilization or Less.

Credit utilization can be defined as that part of your credit limit that you can use at any time. This is the second most important factor after having a good payment history.

For instance, the purpose of paying your credit card balances every month. However, should you fail to pay well, then try as much to maintain the balances at a maximum balance of 30%.

As you try to mend your financial standing, try to shape up the limit and, if possible, reach a limit of 10%. By doing this, you will eventually raise your credit scores.

- Consolidate Your Debts

Consolidating your loans is another important factor to consider ifyou want to improve your credit scores. You can consolidate all of them into one loan, and the interest will be lower if you have good credit scores. This translate to a lower repayment amount, which is possible to deal with.

Doing this reduces the burden of making several repayments to multiple institutions, and you stand a chance to improve your credit scores.

Conclusion

There are many banks and licensed moneylenders that can do this. Still, at SGP credit, we have friendly customer service and negotiable interest rates; you too can try us today, and we assure you of better credit scores.